It takes serious luck to win a big jackpot—and serious planning to keep it safe. Winners of prizes totalling several hundred thousand dollars or more often fall victim to scam artists, bad investments, or legal trouble.

For this reason, lawyers who specialize in estates and trusts recommend remaining anonymous and only telling your closest family members that you’ve won a large jackpot. The pros also recommend creating a lottery trust to ensure that your identity is tightly under wraps and that your money is carefully dealt with, according to your wishes. Here’s why you should set up a lottery trust and how to do it right.

While lottery winners can easily remain anonymous in many European countries, the UK, Australia, and China, only nine American states (Georgia, Maryland, Texas, Ohio, Delaware, Kansas, South Carolina, North Dakota, and New Jersey) allow winners to conceal their names from the public eye. All other state lotteries default to revealing winners’ identities on lotto organizations’ websites and even in press conferences.

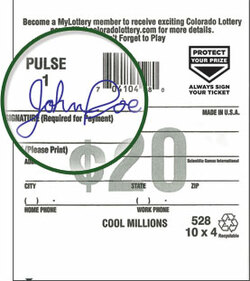

Although some winners, such as Bill Lawrence, manage to stay anonymous even though their names are published, lotto winners who want to stay completely anonymous must take action before claiming their winnings to protect themselves from media attention. Unless you're in China, where the government encourages winners to stay anonymous by wearing costumes when claiming their prizes, creating a lottery trust is the best way to do this.

A lottery trust acts on the winner’s behalf to collect and distribute the prize money as he or she wishes. Since many state lotteries mandate that there should only be one payee per ticket, a trust can also act as the payee in a situation with multiple winners. The trust then ensures that the prize money is distributed fairly to all parties. These are just some of the benefits of having a trust collect and manage your winnings—even if the reasons that lottery operators and jurisdictions have for wanting winners to go public are valid.

LOTTERY TRUST CONS

There are a few types of trusts that you can use to protect your winnings and shield your identity:

A revocable can be cancelled or changed at any time. A trust document lays out the name of the trustee (the organization that will handle the winnings), the names of all beneficiaries, and details the terms of the trust. A revocable trust becomes irrevocable if the grantor—the person who created the trust—passes away. This keeps the trust’s funds out of the extremely expensive probate court process to determine where it should go.

An irrevocable trust is a good way to split funds among multiple winners. When this trust is created, ownership of the prize money is transferred to the trustee. Irrevocable trusts remove the funds from your taxable estate, so you won’t have to pay taxes on any income the funds generate if they’re invested. The trust also can’t be cancelled or altered without agreement from all beneficiaries, so it protects the money from creditors and any lawsuits or disagreements among the winners.

In a blind trust, the trustee manages and invests the funds without the grantor’s or any beneficiary’s direct knowledge. A blind trust separates the winner’s assets from his or her professional or political actions, which is useful for avoiding conflicts of interest. A blind trust can be revocable or irrevocable.

Most international lotteries give winners at least six months to claim their prizes, which is plenty of time to make arrangements, consult professionals, and set up a trust to guard your money and your identity. Here’s how to create a trust:

If you win a major prize—and don't lose your lottery ticket, of course—then creating a lottery trust is a smart way to protect your identity and your money. Getting help from reputable financial and legal professionals who specialize in lottery winnings can help you distribute and invest your money wisely. To avoid unpleasant surprises, choose your trustee wisely—and make sure to understand your state’s rules on taxing trusts, taxing lottery prizes, and altering the trust in the future.